Running a business is hard enough. It gets even harder when unexpected things occur like a stolen business credit card, an auto accident involving a company vehicle or an employee is hurt on the job. Unfortunately, many of these situations are just accidents and are bound to happen at some point in a small business’ lifetime. What matters at these particular points in time is how a small business is prepared and handles these events, because these examples could make or break a company if they are ill-prepared.

That is where insurance comes in. Insurance is a way to protect yourself and your company in the event of an unexpected mishap. For this reason, having yourself insured and covered is a must. However, there are just about as many insurance companies and different policies as there are potential mishaps. You can protect yourself with general liability coverage that will shield you from many unfortunate events but you can get as specific as insurance coverage on your copy machine. Determining your coverage needs seems like an endless and daunting task from a bird’s eye view, but here are a few insurance plans to consider for your small business that can certainly help get you going in the right direction and be covered sooner rather than later.

This is your basic commercial insurance that most companies start with. General liability insurance is there to cover you for any usual business risk, such as the injury to a customer or lawsuits brought against you. It is limited on how much it will pay out in these instances and may not cover more specific situations such as theft, employee injury or vehicle accidents, even if they are associated with the lawsuit itself. For these instances, you would have to extend your policy and add additional coverage. The good thing about general liability insurance is that it protects you on the legal front whether suit claims are viable or not. Your business won’t have to shell out tons of money for court and administrative fees for any little claim that comes against you.

Errors and Omissions Insurance

This coverage can go by many names such as “professional liability insurance” or “professional indemnity insurance.” Regardless of what you call it, this coverage is great for the small business professional. Errors and omissions insurance is a type of legal insurance that covers you if you are accused of causing financial harm to a client due to a mistake you made through your service or lack of services provided. Often in the medical industry, this same insurance is called “malpractice insurance.” Error and omissions insurance works the same way but for different industries. Many technology-heavy companies use this insurance in the instance their hardware fails. Consultants also take E&O Insurance in case they have a claim brought against their consultations later on.

But remember, this insurance is different and separate from general liability insurance. General liability covers physical harm related suits and E&O insurance covers financial harm related suits. You may need both to cover all of your bases depending on your industry and line of work.

Whether you have one employee or 1,000, it is important to protect yourself and your employees in case of an on-the-job injury. If an employee is harmed performing job duties, your company will likely be on the hook to pay medical care, rehabilitation or lost wages to that employee. This is where workers’ compensation comes in. Workers’ comp will cover the cost of the employees’ lost wages and medical care and ensure the employee is seeking care. This insurance coverage makes sure your employee is taken care of during this tough time and that you are not sunk paying exorbitant medical bills.

We live in a digital world, so it’s a guarantee your company is somehow technologically connected, whether that is with a POS system that processes credit cards, an email subscription list, customers’ personal contact information or business credit cards for everyday expenses. With all of these wonderful technologies comes the possibility of a data breach or fraudulent activity in which your company needs to be prepared. This can come in the form of customer information being stolen or distributed. Your business credit card may also be stolen or otherwise used fraudulently. It could even be that your company files are held by ransomware. In any of these cases, data breach or fraud insurance can save you lots of money and headaches. This type of insurance will first set you up with or guide you in finding software that can protect your technology from breaches. In the event of a breach, it can quickly monitor and do damage control. Finally, it can provide coverage for aftermath options like credit monitoring for your customers. This type of insurance should not be easily overlooked, as every company is somehow connected to the technology grid at this point and thus equally at risk.

Many businesses, big and small, utilize vehicles to get the job done. From trucking big-rigs and construction backhoes to utility pickup trucks and the staff sedan, it is important to cover your company vehicles. Commercial auto insurance is similar to your regular auto insurance because it covers for auto accidents that were caused by you or happened to you. It is different in that it covers any vehicle your company uses–forklifts, cars, golf carts, construction equipment or trailers. Any vehicle used for business purposes is covered under this policy and thus protects your business and your drivers in the event of an accident or loss. If your vehicles often in your line of work, this is definitely a coverage option you want to consider.

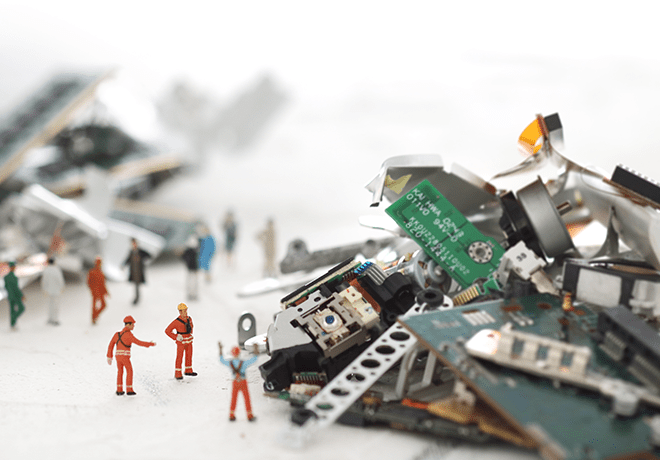

Similar to auto insurance is commercial property insurance. There are many different types of property that a company can be liable for. This is especially true for companies with footprints outside of the office, such as utility or electric companies, railroads, oil mining or telecommunications. These industry types often utilize poles, wires, utility boxes, signs or other equipment that is off-site from their office and spread over a large area. This means these items cannot be maintained or monitored 24/7. In the event one of these objects is stolen, broken or hurts a passerby it falls to the company to take responsibility–this is where commercial property insurance comes in. This type of insurance can cover any damages or losses for commercial property that you may have. This can extend to your office as well if you have a break in, fire or break down of on-site equipment. Overall, this coverage is great to have if you have off-site equipment that could be at-risk or a large amount of inventory you can’t afford to lose.

If you are a partnership, you may want to consider having a life insurance policy on yourself as well as your business partner. This will protect your company in the unfortunate event that one of you passes away. For example, if you own an architecture firm in which you are the accountant and your partner is the architect, and your partner passes away, you are left without a company, which means lost income. If your partner had a life insurance policy in place for the company then you will have some income to work with while you find a new architect to keep the business working or settle any debts and dissolve the company. Either way, this keeps each partner safe from being saddled with the burden that may come with a business partner’s death. While it may be a tough conversation to have, it isn’t one that should be avoided.

Property insurance will often cover or replace lost inventory or equipment and any building or renters insurance you have may cover damages to your building, but there is the possibility of exemptions when it comes to weather. Many insurance companies do not include known weather risks in their policy coverage so it is important that you read the fine print of your policies. For example, you may notice that flood or hurricane damage may not be included in your policy if you are located in Florida. This is problematic because you and the insurance company both know there is a high probability of hurricane or flood damages happening if you have a business in Florida. This is where you may need to take out supplemental policies like flood insurance or sinkhole insurance (if you are in a state with frequent earthquakes). These supplemental policies do add a bit more to your insurance premiums each month but can ultimately keep your company from going under if the worst does happen when it comes to weather-related incidents. Again, the biggest thing here is to thoroughly read your policy and determine if additional insurance is needed based on what isn’t covered.

Related: HOW TO PREPARE YOUR BUSINESS FOR UNPLANNED EMERGENCIES

Find Coverage

The Small Business Administrationrecommends a few actions when you begin the insurance shopping journey: Asses your risks, contact a licensed agent, shop around and assess each year.

Obviously, the first step in this process is to assess the risks that your business needs covered. Do you have employees working in a high-risk environment or do you have a large fleet of vehicles? Do you work with volatile materials or do you have a vast inventory to maintain? Looking at the possible risks your business faces can help you decide what insurance to begin shopping for.

Next, you will want to contact a licensed agent. Just as your customers come to you for your specific industry knowledge and expertise, it is best to consult an expert when it comes to what business insurance will best suit your needs. They can find and price policies that will keep you covered and stick within your budget. Be sure the agent you speak with is a licensed agent so you know you are getting correct and legal counseling on your insurance. If you want to check that your insurance agent is licensed you can simply search “insurance license lookup” and your state name on your browser.

As the recommendation states, you may want to reach out to more than one broker so you can have a second opinion on what coverage you will need and have a chance to shop around on price.

Once you sign the paperwork and are covered, that’s it! Just make sure your insurance premiums are paid each month and you keep your coverage details somewhere safe and accessible in case of an incident. In the meantime you can get back to running your business and being (relatively) worry-free knowing when something does happen, you are safe and covered.

Finally, each year reassess your insurance needs and adjust your policy as need be. If you have grown or expanded, you may have taken on new risks that need to be covered. Vice versa, if you have downsized or changed your business model, then you may be covered for risks that no longer exist. Discuss these changes with your agent so they can adjust your coverage accordingly.

In some instances, you can even look for a small business insurance package like this one. These are pre-packaged to offer the coverage a small business is likely to need at an affordable price point. Often, these insurance packages include general liability insurance, commercial property and workers’ compensation, but be sure to shop around since some companies may offer additional coverage.

There are also insurance companies out there withpackages for more specific business needs<. This is especially helpful for high-risk businesses such as utilities or mining. These packages won’t likely be spelled out up front because they can include a plethora of specific coverage aspects for your company needs that would greatly fluctuate the price. These are still worth a look as it may be a great money saver on your monthly premium.

No one wants the situation examples above to happen to them and they certainly never come at an opportune time. When you have a small business you need to look at these risks not so much with an “if” mindset but a “when” mindset. These accidents and lawsuits will happen; it’s just a matter of when they will happen. With this in mind, don’t wait until the event occurs to seek out insurance to cover your bases. Be sure you are protected no matter what happens or when it occurs.